Waking up to a busted fuse box isn’t half as shocking as a surprise claim without insurance. That gut-punch feeling when life zaps your business overnight – that’s the stress no one warns about. We get it, the wiring of your work runs deeper than the job site.

There’s gear to protect, contracts on the line, and a team counting on you to keep things running. But between quoting jobs and wrangling invoices, finding the right cover feels like one more headache you didn’t sign up for.

At Sparky Sales Systems, we work with business owners like you every day. While you focus on building your business, we’re here to help you protect it and scale it stronger.

Our expert coaching empowers electricians to step off the tools and grow profitably through proven systems, tailored training, and a supportive community, so you can hit that seven-figure milestone with confidence. Let’s walk through why having the right business insurance is a critical part of that journey.

Types of Insurance for Electricians

Your tools power homes, but even a single spark can trigger thousands in liabilities. That’s where choosing the right insurance policies becomes more than wise – it becomes part of your business foundations.

With hands-on experience running Olympic Electrical and supporting others through Sparky Sales Systems, we understand how one missed cover can flip everything. From liability to tool protection, each cover plays a unique role in building a strong and secure electrical business.

Public Liability Insurance

No matter how careful the work, one mistake can end in damage or injury. That’s why public liability insurance stays at the top of the list. It steps in if a client trips on your cable or you accidentally fry a customer’s appliance. Risks like these don’t just cost money – they challenge trust.

Across Australia, rules vary, but most licenses demand public liability. Costs shift with your coverage amount, business location, and claims history. It’s the kind of protection no electrician should go without, especially when clients and regulators expect it as part of doing things right.

Professional Indemnity Insurance

If your business includes giving advice, planning switchboard layouts, or EV charger installs, indemnity insurance matters. Mistakes in design or incorrect advice can lead to serious – and expensive – consequences. That’s where this type of policy offers protection.

It won’t cover intentional errors or criminal acts, and comparing limits and exclusions across providers is key. Choose a policy that understands the risks of project planning so that your advice doesn’t cost you more than expected.

Tools, Equipment, and Contents Cover

Your tools don’t just fill your ute; they fuel your income. When theft or loss hits, it’s not just an inconvenience – it’s a pause in your earnings. That’s why tool insurance handles both during-site use and vehicle transport situations.

If your trailers or vans double as storage, you’ll want to address coverage for contents left overnight. Including transit protection also helps keep everything covered while commuting between sites with your gear at risk on the road.

Personal Accident and Illness Cover

When you run the business, being off work means more than missed wages – it impacts every moving part. Personal accident and illness cover supports you during downtime caused by injury or sickness. It won’t wait for the accident to happen at work either – it covers both on and off-site situations.

This differs from workers’ comp, which only applies when injured on the job. Accident coverage helps bridge that wider safety net when you’re self-employed or running the show solo without sick leave to fall back on.

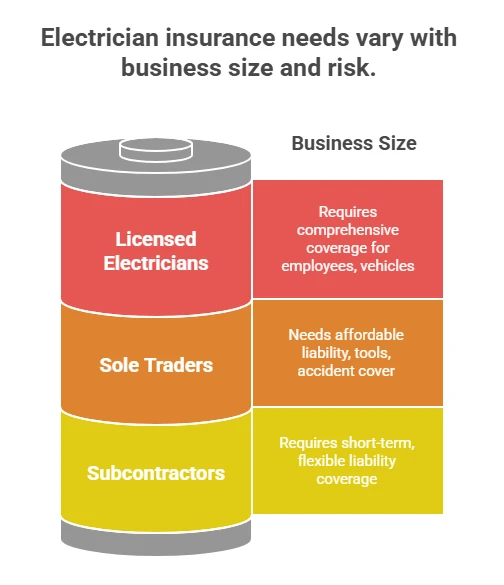

Who Needs Electrician Business Insurance

Cover isn’t just about ticking license boxes – it’s about running a serious business. Whether you’re quoting for a residential install or managing a growing fleet, your insurance needs change with your growth. We see this every day with electricians taking their operations from the tools to team leadership through Sparky Sales Systems.

Licensed Electricians and Electrical Contractors

Your license opens the door to jobs, but your insurance keeps it from slamming shut. Contractors face different risks depending on whether they’re a lone operator or running a business. Larger teams and larger projects mean larger liabilities.

The key difference lies in business structure: sole traders may only need the basics, while companies must consider employee safety, vehicle fleets, and management responsibility. When it scales, so must the protection.

Sole Traders and Self-Employed Electricians

Being your own boss means taking all the calls – even the hard ones. A single accident could drain savings overnight. That’s why tailored options matter for sole traders. They balance affordability with key protection like liability, tools, and accident cover.

Your day-to-day life is fast-paced and unpredictable. Having the right policy protects you from sudden expenses so you can focus on serving clients without stress hanging over your head.

Subcontractors and Casual Workers

If you’re picking up work casually or filling short-term contracts, you still face the same risks. Public liability doesn’t pause just because the work does. Many projects now require freelancers to bring their own cover.

Thankfully, you can explore daily and short-term options that offer quick access and flexible limits. These are perfect for gig-based electricians who don’t work full-time or are still building up client bases.

Cost of Business Insurance for Electricians in Australia

Budgeting for protection doesn’t need to be short your circuit. Knowing your risks and business profile helps determine where your policy costs fall. From our work with different electricians, we know that stable revenue and solid systems create space for the right cover without hurting profitability.

Factors Influencing Premiums

Your premium depends on where you’re based, what work you do, and how many claims sit in your past. Higher-risk services such as EV charging or mains upgrades will usually attract a bump in costs.

Bigger teams, diverse services, or multi-site operations also push costs higher. It’s about risk – the more complex the work, the more protection you may need.

Monthly Payment Options and Flexibility

You don’t have to cough up big amounts upfront. Many providers offer monthly plans to help with cash flow. Some even allow pause or pay-per-day set ups – ideal if your projects vary in size or season.

Providers now offer plans that match your rhythm, so you’re never overpaying when business slows.

Real-World Examples and Averages

For a sole trader, basic public liability might start around $60/month. Add tool cover, and that could reach $100. Bigger firms with employees may hit well over $200/month, depending on services and locations.

We’ve seen costs vary greatly, but spending right saves thousands in claims. The important thing is protecting income and reputation, not finding the cheapest price tag.

Getting an Accurate Insurance Quote

To avoid surprises, be honest when describing your work. Select the right occupation description, include revenue estimates, and detail any risky tasks. That information helps generate a quote that actually fits your scope.

You’ll typically need your ABN, license number, prior claims info, and details about any employees. Having clear documentation avoids delayed approvals or denied coverage when issues pop up later.

Applying for and Managing Your Electrician’s Insurance

Your cover should grow with your business. What works for a solo sparkie doesn’t suit a director with a team. Our focus through Sparky Sales Systems is creating smart systems that evolve alongside your goals – insurance’s no exception.

How to Apply for Cover

You can apply online with most insurers, or use a broker if you’re unsure where to start. Brokers help evaluate your risks and match you to the appropriate cover.

Have documentation on income, business details, and your planned services. This helps streamline the process and gets your policy active faster.

Making and Handling Claims

When trouble hits, speed matters. Most insurers allow online claims, but delays happen when info is missing. Provide every detail upfront and take photos where needed.

Common issues include uncovered exclusions or unclear responsibilities. That’s why reviewing your policy when buying is key. It prevents disappointed surprises later.

Renewals, Add-Ons, and Policy Changes

Is your business evolving? So should your cover. Adding new tools, services, or employees means updating your insurance. You can cancel old policies or merge them when growth happens fast.

Annual reviews are smart. It’s about staying properly covered, not just compliant. Even small changes can impact your risk level or payout potential.

Customer Service and Support Tools

Good insurers offer more than policies – they back it with tools. Customer portals, mobile apps, and support teams make access easier when you need help or documents.

Lack of support during claims or renewal can cost time and money. Prioritise providers who show care when it counts the most.

Choosing the Right Insurance Provider

You deserve better than to settle for just any insurer. Great support, flexible plans, and fast claims are worth every dollar spent.

What to Look For in an Insurer

Pick insurers who know trade risk like the back of their hand. Customised covers, stellar reviews, and fair claim resolutions are must-haves.

For electricians, flexibility matters. Your jobs aren’t identical, so your policy shouldn’t be either. Seek providers who offer adjustable options with top-notch advice.

Comparing Top Options in Australia

Certain brands offer a wide range of packages. Some shine in pricing, others in claims of simplicity. The best fit depends on how your business is structured.

Checking reviews and coverage quality side-by-side helps you make choices that aren’t just about price, but peace of mind.

Bundled vs Individual Policies

Bundling can save money and reduce policy clashes. But it can also limit choices. On the other hand, going with separate insurers lets you tailor each area.

Each path has its ups and downs. The goal is to avoid overlaps or gaps, especially as business complexity increases over time.

Legal and Safety Considerations

Your license protects the public. Your insurance protects your business. As compliance evolves, understanding how insurance fits into safety and operational protocols becomes critical to stability.

Insurance Requirements by State

In places like Victoria or Queensland, public liability often ties into licensing. Ignoring the cover puts your license and livelihood at risk. Melbourne contractors face specific checks during audits, too.

Always check your local authority’s guidelines. Some even review business insurance during random inspections or when you renew accreditations.

Business Risk and Safety Management

Professionalism isn’t just branding – it’s safety and reputation. Risk assessments reduce accidents and protect workers, safeguards that can also lower premiums.

During training through Sparky Sales Systems, we stress that clean job sites, clear procedures, and documented safety checklists aren’t extras – they’re smart risk reducers.

Avoiding Underinsurance

Covering $20,000 worth of gear with a $5,000 limit won’t help in a theft. Underinsurance leads to nasty surprises when claims arrive.

Review assets regularly and match cover accordingly. If your business has grown from solo jobs to team installs, your policy should show that.